maine excise tax credit

An owner or lessee who has paid the excise or property tax for a vehicle the ownership or registration of which is transferred or that is subsequently totally lost by fire theft or. Excise tax paid on gasoline purchased in Maine and used for commercial purposes other than the operation of a registered vehicle on the highways of Maine may be eligible for a refund.

Child Tax Credit January 2022 When Could Ctc Payments Start In 2022 Marca

An owner or lessee who has paid the excise tax in accordance with this section or the property tax for a vehicle is entitled to a credit up to the maximum amount of the tax previously paid in that.

. Send a Schedule 2 electronically for each fuel. Excise Tax Credit Summary Report. The Maine EIC is available to Maine individual income tax taxpayers who properly claim the federal earned income tax credit on federal Form 1040 or Form 1040-SR or who are otherwise.

SummaryThis bill permits the motor vehicle excise tax credit for transfer or total loss of a motor vehicle to be applied to a vehicle or vehicles acquired by the owner or lessee within 30 days. An owner or lessee who has paid the excise or property tax for a vehicle the ownership or registration of which is transferred or that is subsequently totally lost by fire theft or accident. Excise tax is an annual local town tax paid at the Town Hall where the the vehicle resides for over six 6 months of the year.

Line 3 Gallons Received Tax Unpaid. Send a Schedule 2 electronically for each fuel. Excise tax is paid.

Alternate formats can be requested at 207 626-8475 or via email. Excise Tax Credit Summary Report Rev. A credit for excise tax paid is taken on line 26.

2020 - 2022 Tax Alerts. Excise tax is defined by Maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. We administer the real estate transfer tax commercial forestry excise tax controlling interest transfer tax and telecommunications business equipment tax and we determine annually the.

How much is the credit Well the excise tax you already paid was 44100 and the excise tax on the car youre registering today is 26350 So Ive got a credit of over. Excise Tax Reimbursement Policy Procedures The State of Maine will reimburse Municipalities for the difference between the excise tax based on the sale price and the Manufacturer. Provides a tax credit against the excise taxes imposed on alcohol manufactured and sold in Maine by a brewer equal to 175 per gallon of malt liquor manufactured and exported by that.

Gallons received tax exempt from sources within Maine. The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehicle. Line 3 Gallons Received Tax Unpaid.

Gallons received from sources within Maine tax exempt. I have entered this info in Federal Taxes under deductions and credits. A credit for excise tax paid is taken on line 28.

Effective July 1 2009 the full diesel excise tax rate is imposed on biodiesel fuels that contain less than 90 biodiesel fuel by volume. Please note this is only for estimation purposes -- the exact cost. 4 The fuel excise tax rates in effect on July 1 2009 were.

An excise tax credit accrues for each vehicle excise tax paid in the prior completed period for which the associated Maine registration was surrendered prior to the expiration of the. To view PDF or Word documents you will need the free document readers. Except for a few statutory exemptions all vehicles registered in the.

Where do I pay the excise tax. Knowingly supplying false information on this form is a Class D Offense.

The Main Hope Of A Nation Lies In The Proper Education Of Its Youth Erasmus Youthday Nationalyouthday Aspireinstitute Education Youth Day National

Tax Exemption In Swat Fill Online Printable Fillable Blank Pdffiller

Spanning Nearly Two Hundred Pages Comprising The Cgst Sgst Act Gst Valuation Determination Useful Of Pr Goods And Service Tax Goods And Services Tax Refund

Gst Rate On Real Estate Or Under Construction Property Purchase 2020 Basunivesh

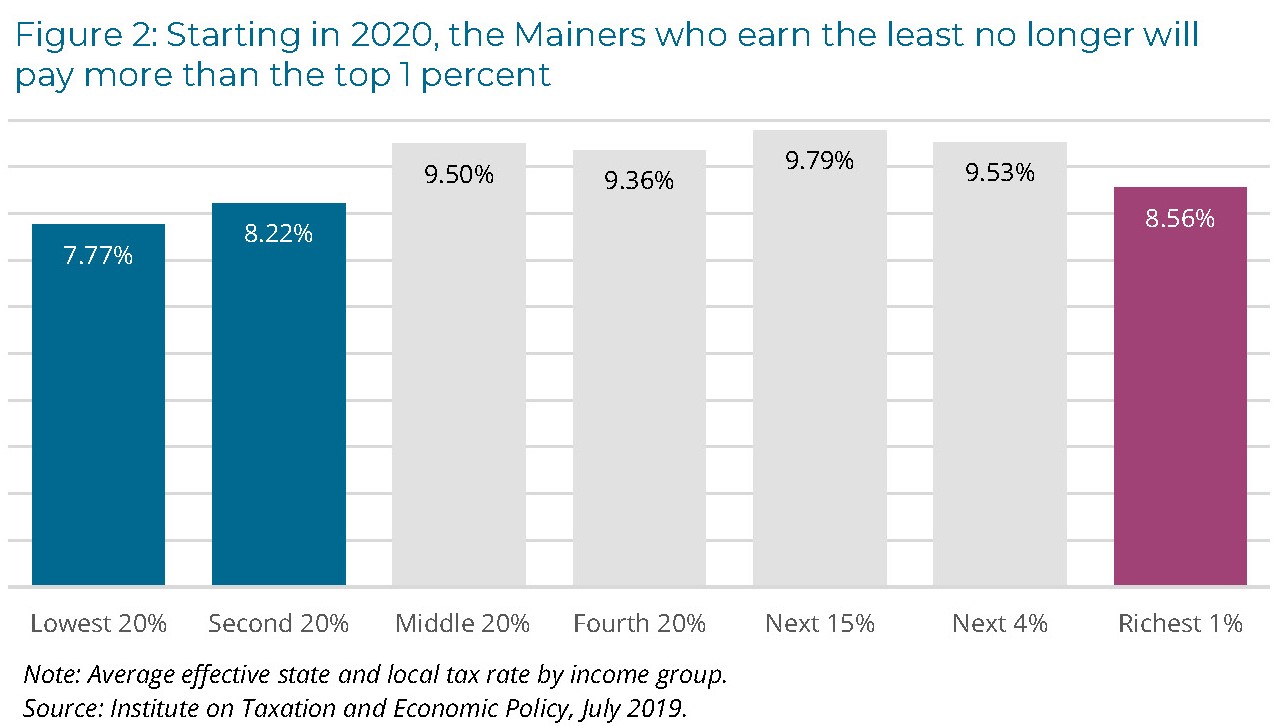

Maine Reaches Tax Fairness Milestone Itep

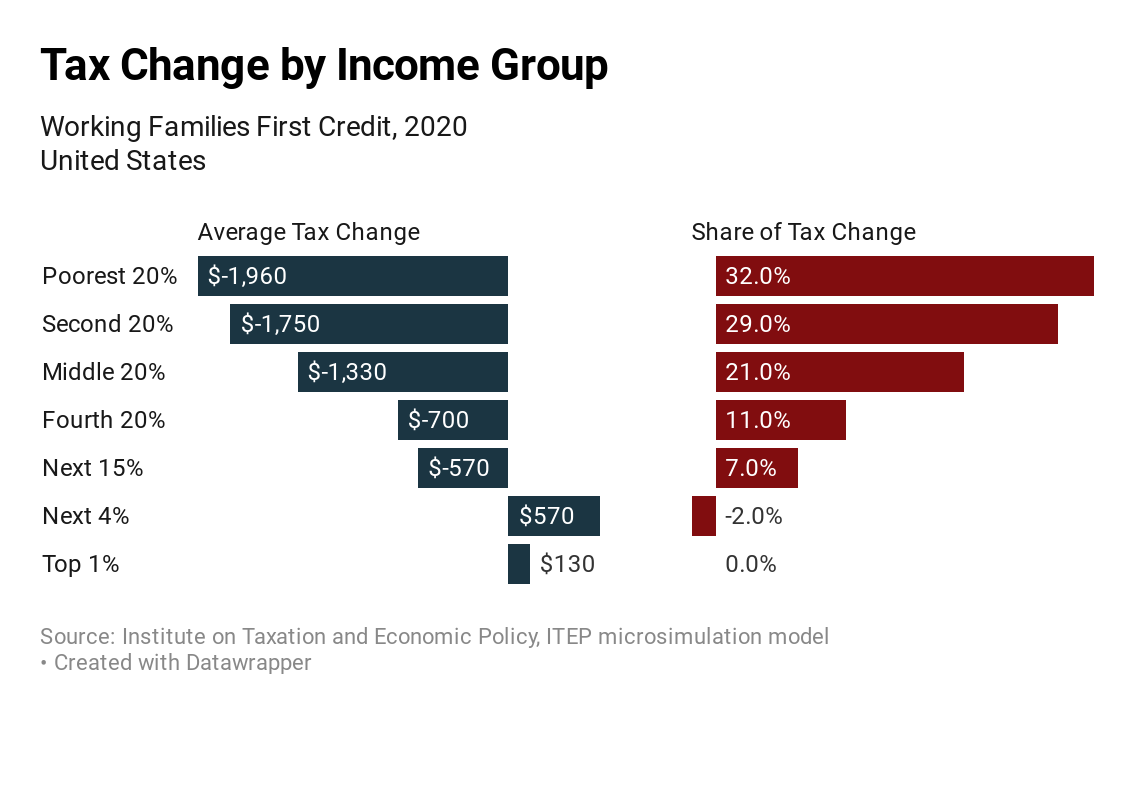

Julian Castro Provides The Latest Proposal To Expand Refundable Tax Credits Itep

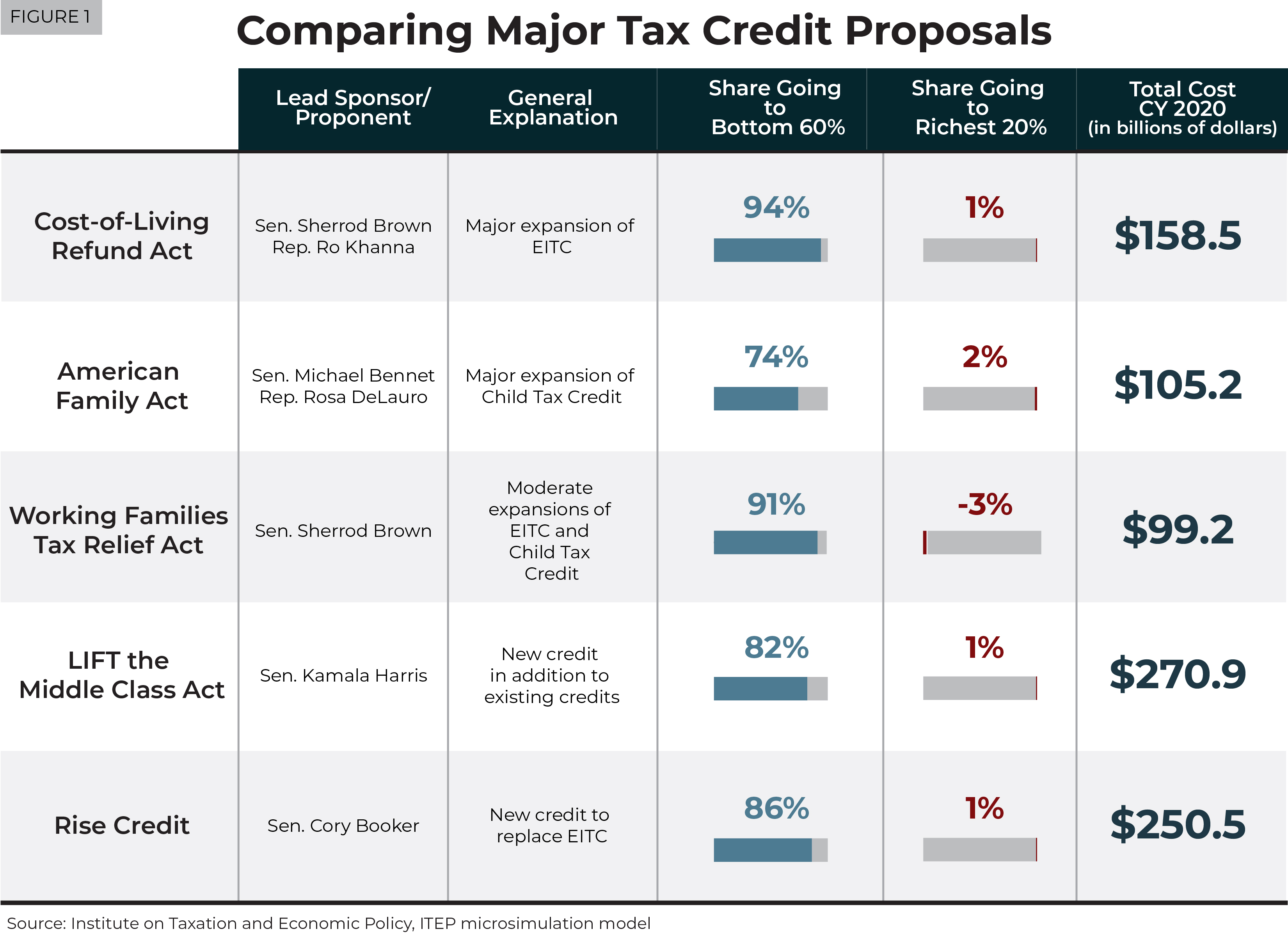

Proposals For Refundable Tax Credits Are Light Years From Tax Policies Enacted In Recent Years Itep

These Are The States Whose Residents Pay The Highest Taxes Income Tax Tax Refund Income Tax Return

Income Profession Tax Benefits For Disabled Handicapped Persons

Schedule Date Of Gst Return Filling For Regular Business Accounting And Finance Accounting Course Filing Taxes

All About Gst Input Tax Credit

Its Tax Times Some Funny Tax Quotes That Will Tickle You Tax Quote Funny Dating Quotes Taxes Humor

Increasing Share Of U S Households Paying No Income Tax

Time Limit To Claim Itc Of Fy 2018 19

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

New Itep Estimates On Biden S Proposal To Expand The Child Tax Credit Itep

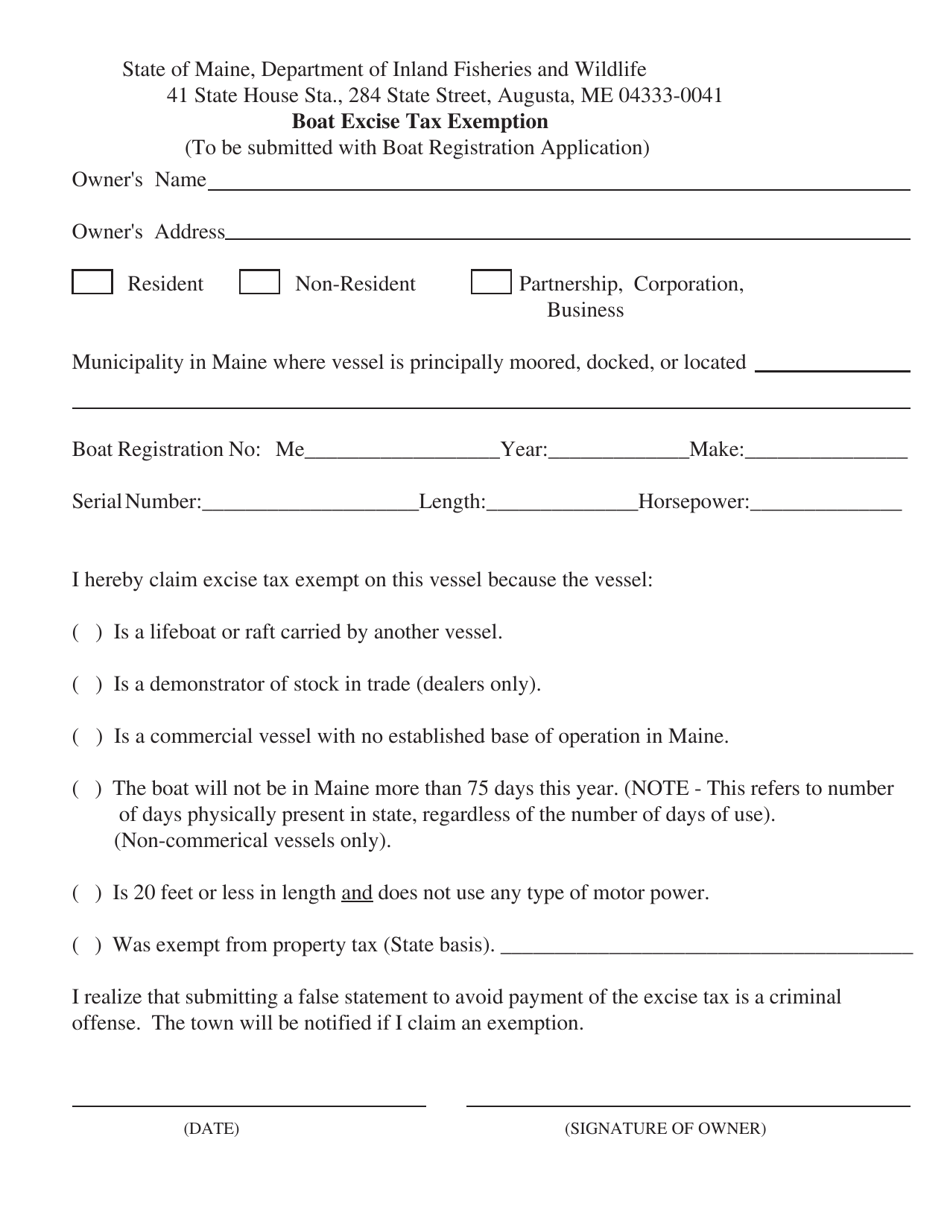

Maine Boat Excise Tax Exemption Download Printable Pdf Templateroller